A lot of people have asked us lately:

“How can you afford to give so much?”

($47,000 last year, approximately 25% of our gross income)

The real answer is simple and humbling:

Our life is bloody incredible.

Not because we’re smarter or harder working than others.

But because we were born in Australia, at a time of unprecedented peace and prosperity.

Because we’ve had opportunities most of the world’s people will never have.

The Global Picture

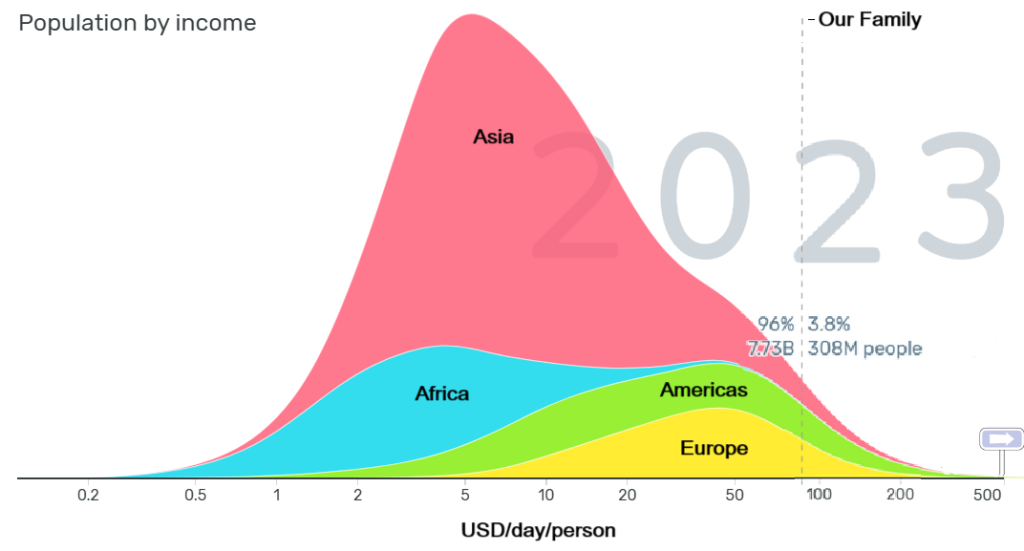

To put it in perspective:

- The median global household income is estimated around USD 14,000 per year

- Our household income at USD 125,000, puts us easily in the richest 5% of the world.

That’s uncomfortable to realize, but also freeing.

Because it means that even small changes in how we live can have huge impacts elsewhere.

And once you see that, it’s very hard to unsee.

Early Lessons: Generosity in the Poorest Places

In our early twenties, Emelie and I traveled independently through South East Asia, mostly by bicycle and train. We spent a month or more each in Vietnam, Laos, Thailand, Malaysia, Myanmar and Cambodia.

We intended to volunteer, to “help.” And we tried. More about that in another post.

What we experienced there changed us far more than anything we gave.

The people with the least, living in single room homes, sharing everything, were the most generous we have ever encountered. One Cambodian family we stayed with had half a dozen chickens scratching around their dirt yard. To welcome us, they insisted on slaughtering one. This would have equivalent to sacrificing a week’s earnings.

They didn’t hesitate. Their generosity wasn’t a calculation. It was a way of life.

From Good Intentions to Better Paths

After seeing how poorly organized volunteer programs sometimes undermined local resilience, we realized:

- Intentions aren’t enough.

- Systems matter.

Rather than short-term interventions, we saw a better path:

- Earn to give – focus on earning in Australia, where we were privileged,

- Then give effectively to support the best, proven organizations making real change.

And importantly:

- Work less where possible, so we could leave space for life beyond just earning.

That decision, to deliberately work part-time and live simply, is the foundation of everything that followed.

Building a Simple, Rich Life

When we returned to Australia, we kept things small and flexible:

- Shared houses, then a friend’s shed, fitted out with salvaged materials and secondhand furniture.

- Simple diets, growing what we could, cooking cheap staples, using “waste” cuts like chicken frames and offal.

- DIY repairs whenever possible, learning to fix what we had instead of replacing it.

- Secondhand everything: clothes, toys, books, cars, appliances.

- Transport built around bicycles, walking, and trains wherever possible.

When we eventually bought our own house in 2010 (AUD 275,000 for the cheapest property we could find near a train line), we focused on paying down the mortgage fast, rented out a room, and DIY-renovated using recycled materials.

We didn’t do it because we had to. We did it because we wanted to buy freedom instead of stuff.

Modern Life: Spending Where It Matters

Today, from the outside, you might not even notice how different our spending is.

We still enjoy life:

- We play squash, take dance classes, have been learning to sail and love a good board game or tabletop RPG.

- We regularly host small festivals at home to celebrate friendships and seasonal harvest.

- Adam and Dani are busy with soccer, swimming, music, and Scouts. All things that cost money, and we’re happy to support them.

But our approach is deliberate.

Whenever we think about buying something, we go through a process:

- Do I actually need it?

- Can I make do with something else?

- Will it bring lasting joy or just short-term dopamine?

- What are the true costs of owning it?

- What will happen to it when I’m done?

- Could I borrow one?

- Can I find it secondhand?

- Is it repairable?

And if we do bring something home, we try to stick to a one-in, one-out policy.

(One new item = one old item given away, sold, or recycled.)

It’s not about being miserly.

It’s about being mindful.

It’s about remembering that everything we own costs more than just money. It costs time, energy, and opportunity.

The term we like to use to describe a focus on enjoying life cheaply is frugal hedonism. It’s freeing.

When We Went Off Course (And Why It Mattered)

We haven’t always been true to our intentions.

After we paid off the mortgage, around 2019, we thought maybe we should “reward” ourselves.

We were earning more. We drank more. We went out more.

We even took a trip to Europe for our anniversary. This partly merged with a business trip to help us justify it.

At the time, it felt normal, though strange to us.

It felt expected, even.

But it didn’t sit right.

The drinking, the spending, the increasing accumulation. It felt hollow. Like we were playing by someone else’s script.

It pulled us further from what mattered to us: connection, purpose, fairness.

It’s not a chapter we’re proud of.

But it was important.

Because it made it impossible to deny:

Living in conflict with our values wasn’t just costly. It was damaging.

And it pushed us to recommit, not entirely out of guilt, but out of clarity.

Our Income: Modest, Yet Extraordinary

In 2024, our gross household income was about AUD 190,000 a year:

- Emelie as a teacher four days per week (~$75k),

- Me working casually as an engineer (~$110k).

- Interest on savings (~$5k)

That’s not small by any measure.

But the real reason we can give so much isn’t because we earn huge salaries.

It’s because we live on about quarter of it — and choose to direct the rest toward giving and future freedom.

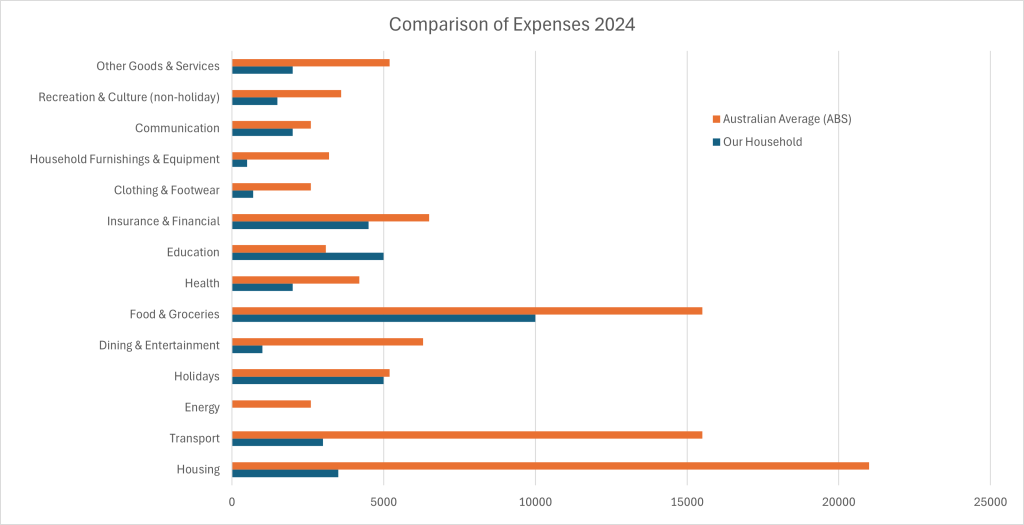

The Long View: What the Numbers Say

Over 20 years:

- The typical Australian household has spent around AUD80,000 per year 【source: ABS HES Reports】.

- Our household has often spent half or less of that, by design, not deprivation.

We:

- Lived closer,

- Lived smaller,

- Traveled slower,

- Fixed what broke,

- Grew what we could,

- Accepted imperfection,

- Chose meaning over luxury.

The result?

Hundreds of thousands of dollars available to direct first to mortgage payments while giving conservatively, then more recently redirected into generous giving, connection, and experiences that mattered.

Freedom Through Simplicity

It’s easy to frame frugality as sacrifice.

But for us, it’s been the opposite.

Frugality bought us time.

Frugality bought us choice.

Frugality bought us the ability to say yes to the things that matter and no to the ones that don’t.

And most importantly:

Frugality bought us the power to give, not just a little, but meaningfully, impactfully.

If You Take One Thing Away…

Our lifestyle is not for everyone.

You don’t need to cycle everywhere, live in a shed or small home, or install solar panels yourself (though you could!).

But every small shift,

every time you pause before buying,

every time you choose less over more,

every time you align your actions with your values,

you open a door.

A door to a freer, more connected, more meaningful life.

And maybe, just maybe, a door for someone else, too.

Because generosity doesn’t just change lives of the recipient.

It changes the life you’re living, right here, right now.

If you would like to undestand just how you could affect the lives of those in need, take a look at this handy Impact Calculator put together by The Life You Can Save.

If you are interested in seeing a visual breakdown of our spending and giving, take a look at the followup post From Soybeans to Sankeys.

Simply amazing!

Thanks Wendy! Is there anything in particular you would like to hear more about?

It’s very inspiring to read and I agree to most of it and doing little steps myself on a path like yours. But: How did your (short) period of the „good life“ done damage? I understand living crisscrossing with your values didn’t feel right in the end. I have to say for me it’s so much easier to give in to a normal life in a rich country as rethink every buy and consume. Yes, it’s may not be in line with my values but the short term entertainment is hard to fight especially with all the marketing around.

Hi Peggy, you raise a good question. To be honest it was not so much the “good life” that caused harm and I would honestly say life is much better now than when we were trying to fit in by jumping on that hedonic treadmill. The damage came from living at odds with our values. This generated an underlying stress I would attribute to identity uncertainty. This discomfort put us in an elevated stress state leading to a spiral of soothing and escapist behaviours and increased conflicts with ourselves, each other and the people around us. You’re absolutely right it is hard to resist the urge to consume and “treat” ourselves and the marketing is so hard to escape. But if you can really nail down your values and get comfortable with them, I’m confident you will find other people wanting the same things so you can find a genuine sense of belonging – one underlying instinct that marketing appeals to.